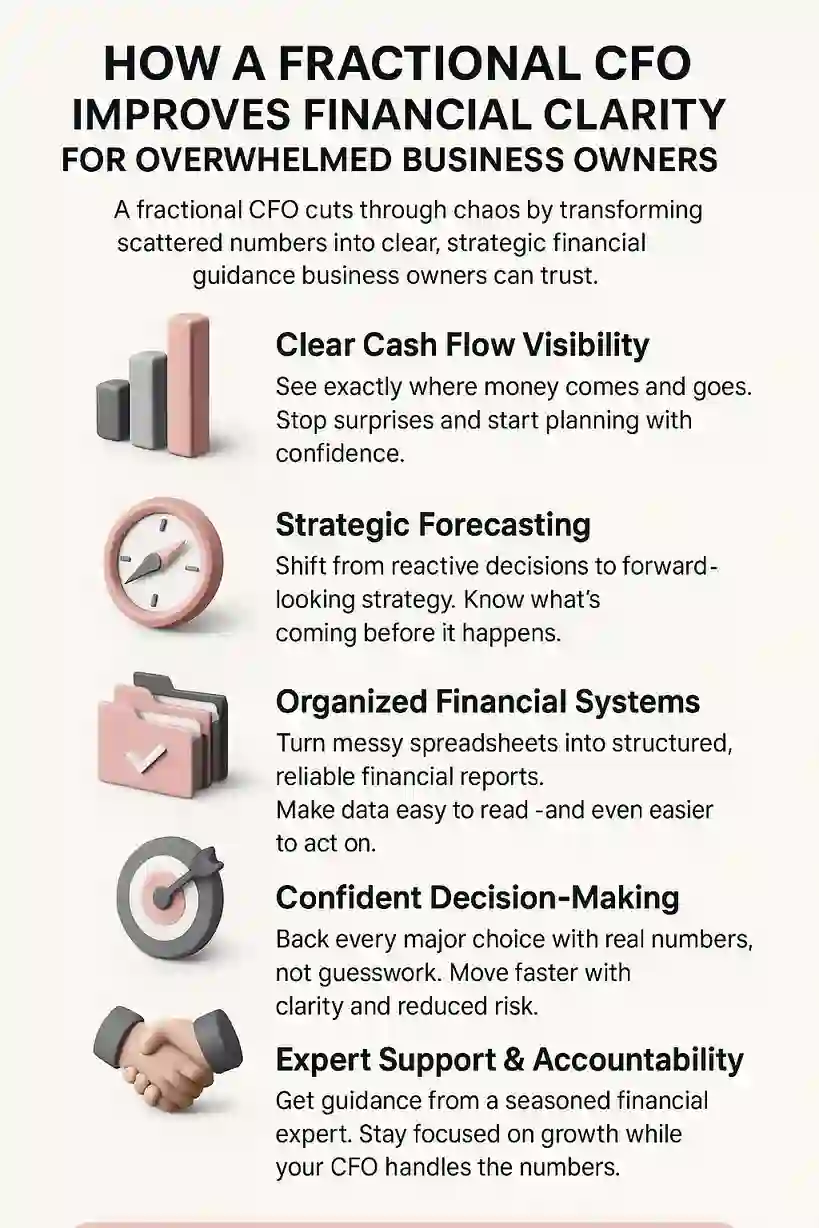

Financial overwhelm often shows up long before a business owner realizes what’s causing it—messy reports, unpredictable cash flow, confusing metrics, or the constant pressure of reacting instead of planning. When the numbers stop making sense and decision-making feels stressful, achieving true financial clarity becomes a critical priority. If you’re trying to understand how a fractional CFO can create that clarity, the short answer is this: they transform disorganized financial data into structured insights and replace guesswork with confident, informed decisions.

At Accountix Solutions, the team has repeatedly observed how fractional CFO services uncover a business’s true financial picture, simplify complex data, and establish reliable systems that make daily operations far easier to manage. Their clients consistently find that financial clarity extends far beyond understanding the numbers—it depends on having the right structure, reporting, and visibility in place so leaders can make smarter decisions with far less stress.

This guide explains how a fractional CFO helps overwhelmed business owners regain control, the clarity-driven systems they implement, and why fractional expertise often becomes the turning point for sustainable, confident growth. By the end, you’ll see how clarity evolves into a strategic advantage—not just a helpful improvement.

Quick Answers

Fractional CFO Services

Fractional CFO services help overwhelmed owners gain financial clarity by organizing the numbers, improving visibility, and turning scattered data into strategic insights. This clarity reduces stress, sharpens decision-making, and gives business owners a clear path forward.

Top Takeaways

- Fractional CFOs help overwhelmed owners turn financial confusion into clarity.

- Most businesses lack clear cash flow visibility and accurate forecasting.

- Better financial insight leads to more confident, strategic decisions.

- Fractional CFOs offer accessible expertise without the cost of a full-time hire.

- Clear systems and reporting reduce stress and support long-term stability.

How a Fractional CFO Helps Business Owners Gain Control and Financial Clarity

A fractional CFO provides the strategic financial leadership needed when a business owner feels overwhelmed by unclear or inconsistent financial information. While bookkeepers and accountants help record what has already happened, a fractional CFO helps owners understand why it happened—and what to do next.

Their role centers on creating clarity. That includes refining reporting structures, improving forecasting accuracy, cleaning up cash flow visibility, and building financial dashboards that make complex information easy to understand. They also identify inconsistencies or blind spots that create confusion, whether it’s inefficient processes, hidden costs, or gaps in financial systems, similar to how accounting services for nonprofits enhance transparency and financial accuracy for mission-driven organizations.

Many owners are surprised by how fast clarity improves. Once reporting becomes accurate and easy to interpret, decisions that once felt stressful—hiring, pricing, spending, expanding—become clearer and more strategic. At Accountix Solutions, we’ve seen fractional CFOs transform overwhelmed owners into confident leaders simply by giving them a clear, reliable picture of their business.

A fractional CFO becomes a trusted partner who brings order to chaos, stabilizes financial understanding, and helps owners plan with confidence. They don’t just clean up the numbers—they help owners see the story behind them.

“Working with overwhelmed business owners, clarity changes everything. A fractional CFO doesn’t just tidy up reports—they uncover what truly drives financial health and give owners the confidence to make decisions with purpose and precision, similar to knowing how to login to run payroll which provides the operational clarity needed to manage staff and financial responsibilities effectively.”

Essential Resources

These resources help overwhelmed owners build foundational financial understanding and deepen clarity while evaluating fractional CFO services:

1. SBA Financial Management Guides — Build Core Financial Clarity

Clear explanations of budgeting, cash flow, and financial controls that help owners understand their finances at a deeper level.

https://www.sba.gov/business-guide/manage-your-business/finances

2. SCORE Financial Projection Templates — Visualize Your Financial Future

Free templates that help owners project cash flow and financial scenarios—critical for gaining clarity before engaging CFO-level support.

https://www.score.org/resource/financial-projections-template

3. Harvard Business Review Finance Insights — Learn Strategic Financial Thinking

Strategic perspectives that help overwhelmed owners understand how CFO-level decision-making improves clarity and long-term planning.

https://hbr.org/topic/finance

4. Investopedia on Outsourced CFOs — Understand the CFO Role Clearly

A simple breakdown of what outsourced and fractional CFOs do—helpful for owners unclear about the role.

https://www.investopedia.com/terms/o/outsourced-cfo.asp

5. Entrepreneur Financial Strategy Articles — Practical Guidance for Confused Owners

Actionable insights that reflect the everyday challenges overwhelmed owners face.

https://www.entrepreneur.com/topic/financial-planning

6. QuickBooks Resource Center — Day-to-Day Clarity Tools

Guides on improving reporting, organizing data, and creating clearer financial workflows.

https://quickbooks.intuit.com/r/

7. Forbes Finance Council — Expert Insights from CFOs and Leaders

Real-world perspectives on strategy, decision-making, and financial clarity from experienced finance leaders.

https://www.forbes.com/finance-council/

Clear explanations of budgeting, cash flow, and financial controls that help owners understand their finances at a deeper level.

https://www.sba.gov/business-guide/manage-your-business/finances

Free templates that help owners project cash flow and financial scenarios—critical for gaining clarity before engaging CFO-level support.

https://www.score.org/resource/financial-projections-template

Strategic perspectives that help overwhelmed owners understand how CFO-level decision-making improves clarity and long-term planning.

https://hbr.org/topic/finance

A simple breakdown of what outsourced and fractional CFOs do—helpful for owners unclear about the role.

https://www.investopedia.com/terms/o/outsourced-cfo.asp

Actionable insights that reflect the everyday challenges overwhelmed owners face.

https://www.entrepreneur.com/topic/financial-planning

Guides on improving reporting, organizing data, and creating clearer financial workflows.

https://quickbooks.intuit.com/r/

Real-world perspectives on strategy, decision-making, and financial clarity from experienced finance leaders.

https://www.forbes.com/finance-council/

Supporting Statistics

Small businesses make up 99.9% of U.S. firms, yet most lack the financial clarity needed to make confident decisions.

Source: Federal Reserve

Rising costs, uneven cash flow, and unclear financial reporting are among the top challenges small businesses face—common causes of overwhelm.

Source: Federal Reserve Small Business Credit Survey

Less than half of small businesses say their credit needs are met, often due to unclear financials or inconsistent reporting—areas fractional CFOs routinely improve.

Source: Federal Reserve

New businesses have only a 71%–85% chance of surviving their first year, underscoring the importance of strong financial clarity early on.

Source: U.S. Bureau of Labor Statistics

Together, these statistics show that overwhelm is common—but clarity is achievable with the right financial support.

Source: Federal Reserve

Source: Federal Reserve Small Business Credit Survey

Source: Federal Reserve

Source: U.S. Bureau of Labor Statistics

Final Thought & Opinion

Financial overwhelm is more common than most business owners realize. When your reports are unclear, your cash flow unpredictable, or your numbers inconsistent, every decision feels heavier than it should. Our experience shows that clarity—not more effort—is the solution.

Here’s what stands out:

Overwhelm often comes from missing or unclear financial systems.

Once owners see their numbers clearly, stress decreases immediately.

Fractional CFOs turn confusion into structure and strategy.

Clarity creates confidence—and confidence drives better decisions.

From our perspective, the shift is dramatic. When an overwhelmed business owner gains financial clarity, everything changes: decisions become sharper, planning becomes easier, and growth becomes achievable, a transformation also seen in private high schools that rely on strong financial visibility to support long-term stability and strategic planning.

The bottom line: A fractional CFO doesn’t just organize financial information—they give owners the clarity needed to lead their business with confidence.

Overwhelm often comes from missing or unclear financial systems.

Once owners see their numbers clearly, stress decreases immediately.

Fractional CFOs turn confusion into structure and strategy.

Clarity creates confidence—and confidence drives better decisions.

Next Steps

Review your current financial reports. Identify any confusion or gaps.

Pinpoint your biggest clarity issues. Cash flow? Forecasting? Reporting?

Decide whether you need strategic support. Overwhelm is a strong indicator.

Use recommended resources to deepen clarity.

Prepare questions for a fractional CFO. Focus on clarity, process, and experience.

Schedule a consultation. Even one conversation can reveal next steps.

Start organizing your financial data. Small improvements build momentum.

Review your current financial reports. Identify any confusion or gaps.

Pinpoint your biggest clarity issues. Cash flow? Forecasting? Reporting?

Decide whether you need strategic support. Overwhelm is a strong indicator.

Use recommended resources to deepen clarity.

Prepare questions for a fractional CFO. Focus on clarity, process, and experience.

Schedule a consultation. Even one conversation can reveal next steps.

Start organizing your financial data. Small improvements build momentum.

FAQ on Fractional CFO Services

Q: How does a fractional CFO improve financial clarity?

A: They turn confusing financial information into clear insights, organize reporting, and create systems that reduce overwhelm and support confident decisions.

Q: When should an overwhelmed business owner consider a fractional CFO?

A: When financial reports feel unclear, decision-making feels reactive, or cash flow becomes unpredictable, it’s time for strategic support.

Q: Why is clarity so important for business owners?

A: Clear financial visibility helps owners understand their business, make informed choices, and reduce stress.

Q: How often do fractional CFOs work with overwhelmed owners?

A: Most benefit from weekly or monthly sessions that steadily build clarity and structure.

Q: Can a fractional CFO help untangle messy or confusing financials?

A: Yes—this is one of the most common reasons owners hire them. They bring order, structure, and visibility to disorganized financial data.

A: They turn confusing financial information into clear insights, organize reporting, and create systems that reduce overwhelm and support confident decisions.

A: When financial reports feel unclear, decision-making feels reactive, or cash flow becomes unpredictable, it’s time for strategic support.

A: Clear financial visibility helps owners understand their business, make informed choices, and reduce stress.

A: Most benefit from weekly or monthly sessions that steadily build clarity and structure.

A: Yes—this is one of the most common reasons owners hire them. They bring order, structure, and visibility to disorganized financial data.